MECU is bending the usual rules so you can benefit more.

To make your body more flexible, you have to do hours of yoga or stretching exercises. It takes far less effort to make your investments more flexible. Even after you open a MECU Credit Union SuperFlex CD, you can keep adding to your account. And that extra money can help expand your interest earnings.Put more in. Take some out. The next move is up to you.

With most certificates of deposit from banks in Baltimore and elsewhere, once you open your CD, you can't put more money in -- or take it out without paying a penalty. But MECU's SuperFlex CD comes with its own twist. You can make unlimited additional deposits and one penalty-free withdrawal before the CD matures.- 11-month CD term

- Minimum opening deposit of $5,000

- Build your investment with automatic transfers from another MECU account

- No withdrawals until seven business days after the initial deposit or any additional deposits

- Withdrawal must leave a balance of at least $1,000

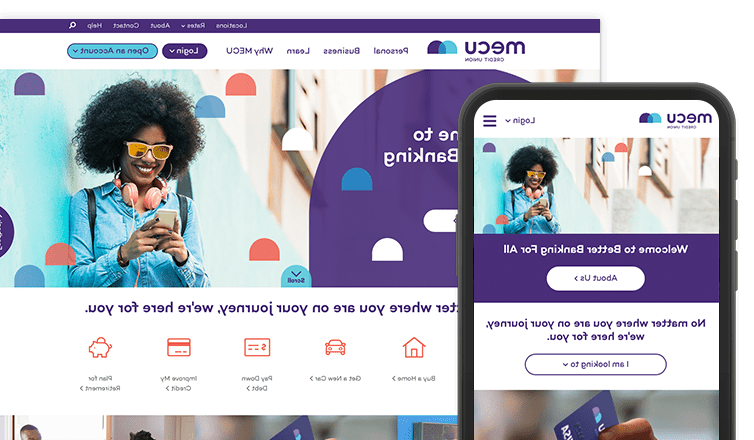

- Watch your saving grow with Online Banking or Mobile Banking

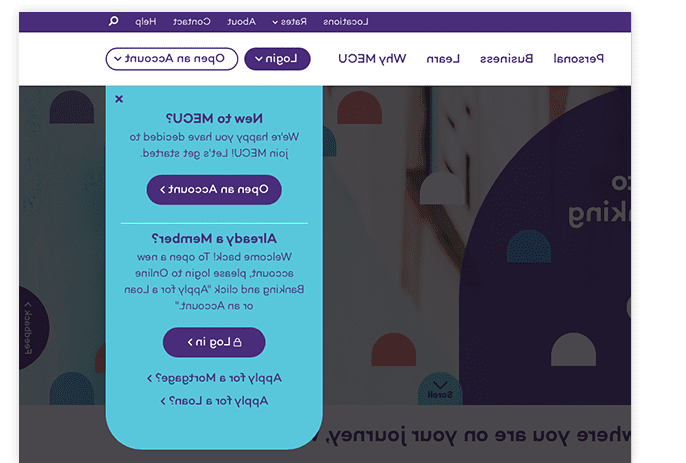

Already a MECU member? Follow the below steps to open your CD:

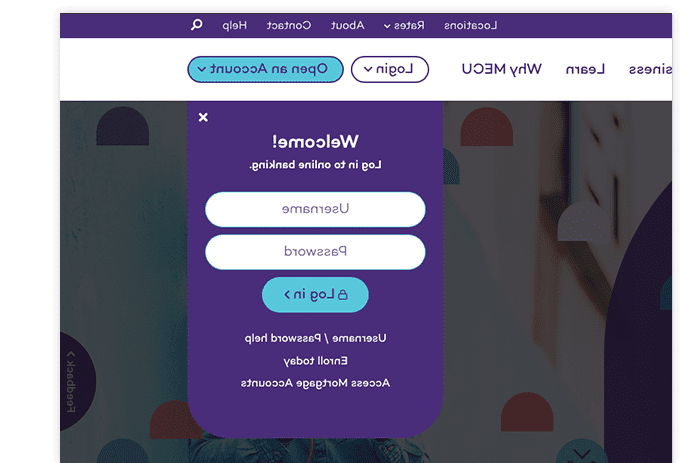

- Log in to Online Banking

- Navigate to "Apply for a Loan or Account"

- Select "Open an Account"

- Click "Secondary Account"